At our May 22, 2023 meeting Danny Hagen, Skagit County Assessor, presented.

Danny is a member of the Rotary Club of Burlington-Morning Club and has been an Assessor Appraiser since 2015. He was a featured speaker in the IAAO (International Association of Assessing Officers Magazine. Danny is highly involved in Community Service/Involvement and has held roles as Advisor, Master Advisor, Shine & Rise Toastmasters, Board of Director Chinook, and Community Action Committee.

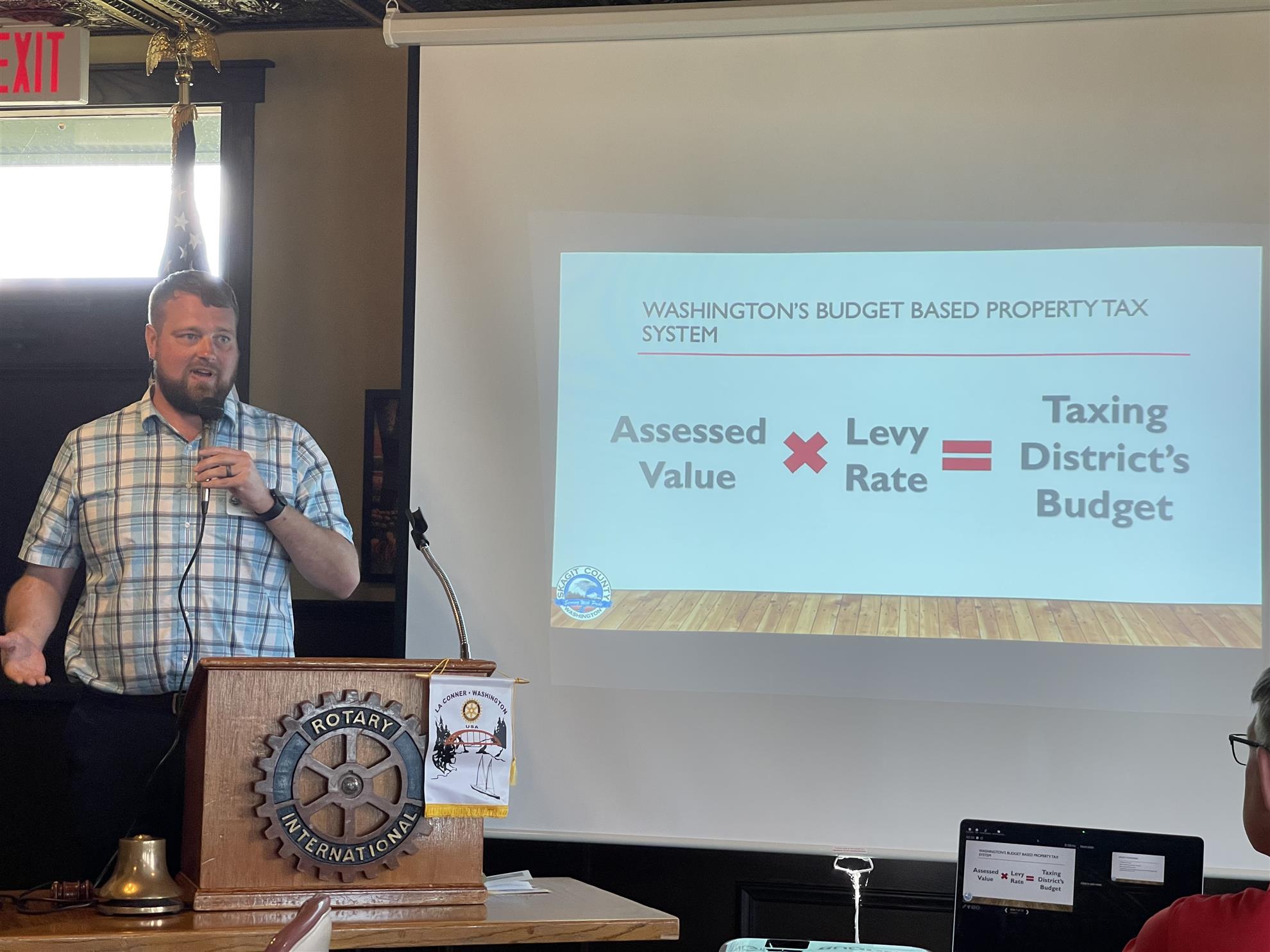

Danny shared with us that his favorite book “A Good Tax-Legal and Policy Issues for the Property Tax in the United States” by Joan Youngman, really helps the reader understand what Property Taxes are about, how they are calculated, and the one tax that strives to be fair and equitable for all and very transparent. Danny’s job as an assessor is to fairly value a property. Assessed Value times the Levy Rate = Taxing Districts Budget.

They are returning to a budget base in 2023 which will help stabilize rates.

Danny reminded us that we should all stay diligent. Go to www.skagitcountynet/search/property which is a one-stop shop to review your data, signup for e-notices, talk to your neighbors, ask questions, and share anomalies you see back to the Skagit County Assessors. They review 80,000 property parcels in Skagit County and are done manually.

The intent of the webpage is Transparency, Local Accountability, and Efficiency

Really great program Danny. Thank you!

Read More:

Danny and his wife Nicole have four children, and all love the beauty of the Skagit Valley and Pacific Northwest where they camp, hike and spend a lot of time outdoors. Danny was also a La Conner High School student and was so impressed with listening to the update on the CTE Chicken Coop project. Danny mentioned that his mother had no interest in what his Father did for a living in framing and construction, which allowed him to be the lucky one, first learning what a bell-shaped curve was.

There are many factors that play into how much a budget can increase, such as the School District, the Fire Department, New Construction Projects, etc. This is when Rate Base vs. Levy Rates are utilized. If the School District for example is in need of a higher budget to ensure proper education programs or to keep up with inflation, a Special Levy can be enacted which then would change the base rate factor. Another factor occurred in 2020-2023 where Property Values increased significantly, causing Property Taxes to increase, even when the base did not change, but was done across the board. Traditionally what you would see is that when the assessed value of a property goes up, the levy rate would go down, but during this time that was the case.

Transparency - How much does each person pay?

Where does it go?

Why am I paying that much?

Is what I am paying fair compared to my neighbors?

Where does it go?

Why am I paying that much?

Is what I am paying fair compared to my neighbors?

Local Accountability – To help understand where the money goes, local decisions are best in deciding how the local portion of the tax is used. Example: Elected officials get approximately 450 votes in La Conner, 1300 School Board, 56,000 votes countywide, 4 million votes in last State Governor race.

Efficiency – Money doesn’t need to go to Olympia or Washington D.C. In a stabilized approach, locally elected officials are able to distribute for a larger percentage of the dollars collected.